Net Asset Value Is Defined As – Definitive Guide to Debt and Leveraged Financing Senior Debt Subordinated Debt Bank Debt vs. Corporate Bonds Corporate Banking Bonds Payable Mezzanine Financing Covenant-Lite Loans Consolidation Loans Bridge Loans Zero Coupon Bonds Unitranche Convertible Bonds High Yield Bonds (HYB) Asset Backed

Determine debt, write off debts payable, sweep cash, interest expense (PIK), interest tax shelter. Loan Loan Variable Interest Rate Fixed Rate Original Interest Rate (OID) Secured Overnight Loan Rate (SOFR) Interest Earned Annually Forever

Net Asset Value Is Defined As

Corporate Bonds Active vs. Passive Investments Exchange Traded Funds (ETFs) Municipal Bond Expense Ratio Commercial Paper Net Asset Value (NAV) Treasury Inflation-Protected Securities (TIPS)Treasury STRIP

Things You Need To Know About Mutual Fund Nav

Credit Analysis Leverage Ratio Interest Coverage Ratio Debt Coverage Ratio (D/E) Debt to Equity Ratio (D/E) Net Debt to Interest Ratio Time (TIE) Cash Flow Available for Debt Service (CFADS) Debt Service Coverage Ratio Debt-to-Asset Ratio (DSCR) Debt-to-Asset Ratio (FCCR) Loss-Given-Default Charge Coverage (LGD) Fixed Ratio (FCCR) Debt-to-Asset Ratio ( DTL) Level of financial leverage (DFL)

Bond Yield Coupon Rate Yield To Maturity (YTM) Current Yield Yield To Call (YTC) Yield To Worst (YTW) Yield Curve Callable Bond Provision Total Purchase Provision Annual Percentage Rate (APR) Percentage Yield annual (APY)

Net Asset Value (NAV) The estimated market value of a mutual fund is a mutual fund and is equal to the total value of assets held less all liabilities.

Net asset value (NAV) often comes up in the context of mutual funds. This is because the metric serves as the basis for determining a mutual fund’s share price.

Value Of A Firm

Unit NAV refers to the price at which units (such as treasury stock) can be purchased or redeemed in a mutual fund. This is usually done at the end of each trading day.

The NAV of a mutual fund is a function of the market capitalization of all the securities held in a portfolio.

However, as is the case with public stock valuations. Past performance of mutual funds does not reflect future performance.

/expenseratio-Final-f7f725e5b63a43af825cf31e6145bc76.png?strip=all)

In addition, the mutual fund’s objectives Risk/reward profile and term should be in accordance with investors’ judgment Instead of evaluating funds based solely on NAV,

Solved] Please Help The Following Information Relates To The Defined…

Because the NAV is usually expressed per unit price, such as per share, the NAV must be divided by the total number of units outstanding.

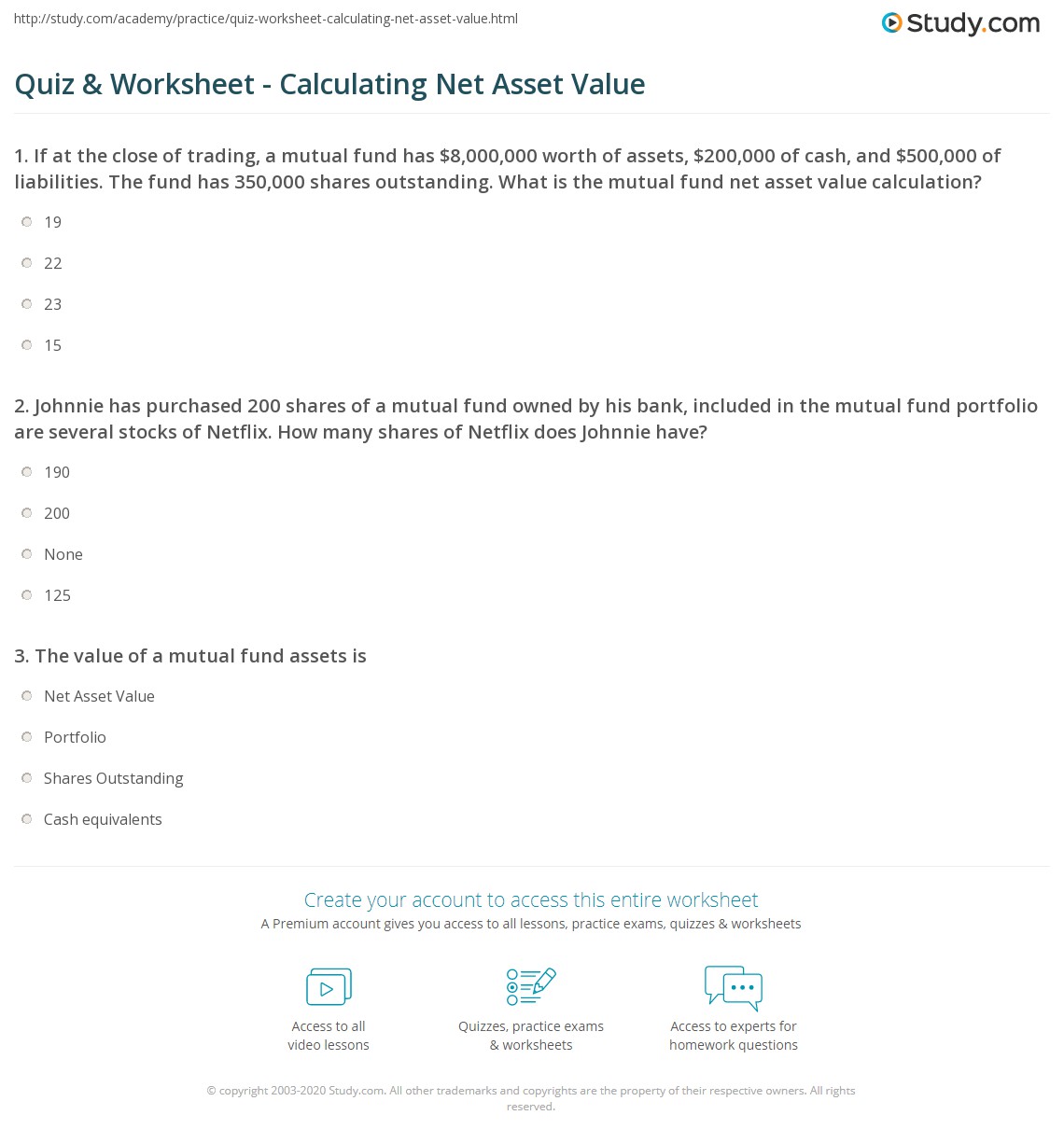

Formula Net Asset Value (NAV) = Fund Assets – Fund Liabilities Net Asset Value (NAV) per Unit = (Fund Assets – Fund Liabilities) ÷ Number of Units Outstanding Mutual Fund NAV Calculation Example

For example, if the mutual fund’s total holdings are $100 million and liabilities are $20 million, the fund’s net asset value is $80 million.

Now that we have subtracted what the fund owes (liabilities) from the value of what the fund owns (assets), the next step is to divide by the total number of units outstanding.

Expense Ratio: Definition, Formula, Components, Example

Assuming the mutual fund has 2 million units outstanding, the NAV per share would be $40.00.

For example, the NAV of an exchange-traded fund (ETF) is based on the underlying asset. While the market price of the ETF is based on the offer/ask of the market.

So far, we’ve talked about net asset value (NAV) in the context of mutual funds. But another use case for NAV is real estate investments, such as real estate investment trusts (REITs).

Here, NAV equals the fair market value (FMV) of real estate assets minus outstanding debt, fixed costs, and capital expenditures (Capex).

Net Asset Value (nav): Definition, Formula & Uses

NAV REIT Valuation Model Step 1: Net Operating Income (NOI) Value-Creating Assets in Real Estate Portfolio Step 2: Value of Secondary Income, i.e. Ancillary Income, Management Fees Joint Venture (JV) Income Step Step 3: Reduce NAV by required costs (such as overhead) and expected future capital expenditures (CapEx) Step 4: Increase REIT assets that have not taken action, eg, Cash Under Construction Step 5: Eliminate debt outstanding and non-capital claims.

After last step The end result is the stock value derived from the NAV, which can be divided by the number of shares outstanding for comparison to the stock market price.

The book value of US REITs is not determined based on fair market value (FMV), but the NAV model adjusts the REIT’s balance sheet to reflect the FMV of the asset with a capitalization rate assumption. (“Max Fee”)

Wall Street Prep’s world-renowned certification program equips trainees with the skills they need to be successful as a bond trader, whether buying or selling.

Net Asset Value (nav): Formula And Calculator (step By Step)

At this moment we are sending the requested file to your email. If you did not receive the email Please check your spam folder before requesting the file again.

Wall Street Prep’s world-renowned certification program prepares trainees with the skills necessary to succeed as a buy-side or sell-side bond trader.

Instant access to video lessons taught by experienced investment bankers. Learn to model DCF, M&A, LBO, Comps and Excel financial statements. The Net Asset Value or NAV shortcut shows the net worth of a company or organization. And it is mainly used to evaluate mutual funds or exchange-traded funds.

NAV shows the price per share of a fund or other entity at a given time. and is used by investors to assess the value of that entity.

Mutual Funds And Other Investment Companies

The NAV reflects the price point at which the stock is trading, so it is important for investors to research potential opportunities.

NAV is defined by subtracting the total value of an entity’s liabilities from assets or securities.

When divided by the total number of shares held, the NAV shows the fund’s value per share. This allows investors to evaluate and make decisions about the management or purchase of shares of the fund or entity.

According to the US Securities and Exchange Commission, mutual funds and hedge funds are required to calculate their NAV at least once a day.

Net Asset Value Versus “everything Else”

Investors often do not compare the NAVs of different funds as they only show the size of the fund.

But it is better to assess the NAV of the same fund over different time periods. This is because it can provide insight into the performance of funds over time. In particular, whether or not the fund’s profits have increased.

Mutual funds generally pay out all of their earnings and capital gains to shareholders on a regular basis. NAV is often a rough measure of the performance of these funds. Due to those regular payments, the NAV was reduced.

However, the NAV is still a useful tool when used in conjunction with other mutual fund evaluations. More precisely, as the total annual return and the compound annual growth rate. Other important factors When choosing between funds to invest, including the operating history of each mutual fund Diversity of securities in each fund and the operating history of the fund manager

How To Read Mutual Fund Fact Sheet?

Because the NAVs of most funds are calculated only once a day. Therefore, its shares are not traded in real time like stocks.

Each investor receives a certain number of shares based on the amount invested in the fund.

The NAV is calculated for each day using the total assets and liabilities of each fund at the end of the day.

Mutual funds work by collecting large amounts of money from investors. instead of investing the money as you see fit

Make A Review About This Article That Include: 1. An

Most investments are determined by the closing price of the underlying stock and make up the majority of the value of the fund’s securities. And therefore the NAV of the Fund

Accounts receivable include things like dividends and interest not paid to the fund. while the accumulated investment is paid in cash to the fund.

Mutual fund liabilities include things like money owed to banks. pending payments and other cash flows as well.

You can also include accrued expenses. This means that the money will be paid soon, as well as the operating costs and fees.

Solved 1. Fingroup Financial Institution Issued An Open End

Good accounting standards lead to accurate NAVs, so these records should be tracked regularly to keep investors up to date.

NAV shows the price per share of a fund or other entity at a given time. and is used by investors to assess the value of that entity.

True is a Certified Personal Finance Educator (CEPF®), author of The Handy Financial Ratios Guide, member of the Society for Advancing Business Editing and Writing, contributing to financial education sites. he is a financial strategist and has spoken with the financial community, such as the CFA Institute, as well as university students, such as his alma mater, Biola University, where he earned a Bachelor of Science in Business and Data Analytics.

To learn more about True, visit his personal website. View author profiles on Amazon or check speaker profiles on the CFA Institute website. Investment funds? What aspects or principles are taken into account? came to a concept called “Net Asset Value” Investing in mutual funds involves the purchase of investment units in a mutual fund project. Each unit starts at the base price and grows or shrinks based on performance. The efficiency of this mutual fund project can be measured by calculating the net asset value of each unit of the project.

Net Book Value Of Assets

NAV stands for Net Asset Value of mutual fund plans. It is the value obtained by subtracting the liability from the total asset value of the mutual fund project per unit. It is the price for which you buy a single unit.

Net working capital is defined as, price to net asset value, net asset value etf, net asset value calculation, net asset value, the net asset value is calculated as, net asset value meaning, cef net asset value, what is net asset value, net asset value private equity, net asset value per share, net asset value reit

Post a Comment for "Net Asset Value Is Defined As"