Calculation Net Present Value – The net present value formula calculates NPV, which is the difference in the present value of cash inflows and cash outflows over a period of time. Net present value (NPV) determines the net present value of all cash flows generated by the project, including the initial investment. Let’s learn the present value formula using solved examples.

The net present value formula is used to estimate which projects are most profitable. Thus, the formula can be expressed as:

Calculation Net Present Value

NPV can be calculated by finding the difference between the Present Value (PV) after tendering the investment period and the initial amount invested, from which the present value ‘PV’ can be calculated after time ‘t’ for a rate of return ‘r’. Such as.

Npv: Net Present Value And How To Calculate It?

There are certain criteria used in the net present value formula that determine whether an investment is good or bad. They are as follows:

Use our free online calculator to solve difficult questions. Find solutions in simple and easy steps.

Example 1: An investor invests $500 in real estate and receives $570 in the following year. If the yield is 10%. Calculate the net present value.

Example 2: Sam bought a house for $750,000 and sells it next year for $990,000 after deducting seller’s fees and taxes. Calculate the net present value if the rate of return is 5%.

Present Value Of An Annuity: How To Calculate & Examples

Example 3: If the rate of return is 5%, that would be the net present value of a box of fruit worth $20,000, which would be worth $45,000 one year from now.

The net present value formula calculates NPV, which is the difference in the present value of cash inflows and cash outflows over a period of time. The net present value formula is used to estimate which projects are most likely to generate the maximum profit. Net present value analysis is a method of cash flow analysis that helps in project selection. In addition, the NPV project selection method falls under the classification of the profit and loss method. In addition, NPV analysis uses the discounted cash flow method to estimate the profitability of a project. In fact, the main advantage of the net present value method is that it uses the concept of the time value of money. My post Project Selection Methods Top 5 Criteria covers mostly the theory of the NPV method in detail. However, this post explains the basic steps in calculating NPV. Additionally, this post will also include a recommended PMP exam question as a study guide.

Let’s consider an npv example problem to show how this technique helps with project selection. First take a project that requires an investment of INR 20,000. And assume the free return is 8%. The next section shows the project’s future cash flows.

Another important feature of the npv calculation is that it is independent of money. In the following example I have used INR, you can replace it with any currency you want.

Calculation Of The Different Categories Of Cash Flows For The Period…

In fact, the Project Management (PMP) certification exam never requires a detailed NPV calculation. However, it is important to understand the steps. NPV PMP exam questions are of the following types

Project A has an NPV of INR 50,000 and takes 1 year to complete. Project B has an NPV of INR 75,000 but takes 2 years to complete. Which project will you choose?

If we have to choose between two projects, we always choose the project with the higher NPV. In fact, the time factor has no basis for selection here, as npv methods take into account the time value of money.

As shown above, the steps to calculate net present value are easy to understand. The NPV project selection process summary is an important financial analysis tool that every project manager should be aware of. However, the PMP test requires knowing the application of basic program selection information.

Introduction To Present Value (video)

Is a project management knowledge development program through knowledge sharing. To know more, Visit About

The blog contains valuable resources that benefit project management professionals and pmp aspirants. Learn More View Resources A project almost always (or at least should) have a promised profit or return to project investors that will be realized over time because the project represents value.

As mentioned in the glossary article Cost Benefit Analysis (CBA), comparing investment options when deciding which projects to prioritize often boils down to which upfront costs will yield the greatest return.

Although the CBA will provide a basic formula for determining the difference between costs and benefits, the assumption in that analysis that present value and future value are the same is not incorrect. That’s why, as an additional step in the process within CBA, Project Managers must determine the Net Present Value, or NPV, of future benefits. Creating NPV allows the project manager to convert all values in the equation to today’s (present) value.

Npv And Irr Calculation

In other words, it enables stakeholders to compare apples to apples and make an informed decision based on accurate data.

Although not part of the NPV formula, the initial use of the investment project must also be known to determine whether the NPV is positive or negative.

For a Project to be considered for approval, the net present value must be positive (the present value of the future benefit is greater than the investment). A negative net present value would mean that the project cannot generate a positive return. A negative NPV does not always mean that the business case should be rejected (for example, a compliance project may have a negative NPV), but a positive NPV will appear more attractive when deciding how to allocate scarce investment dollars.

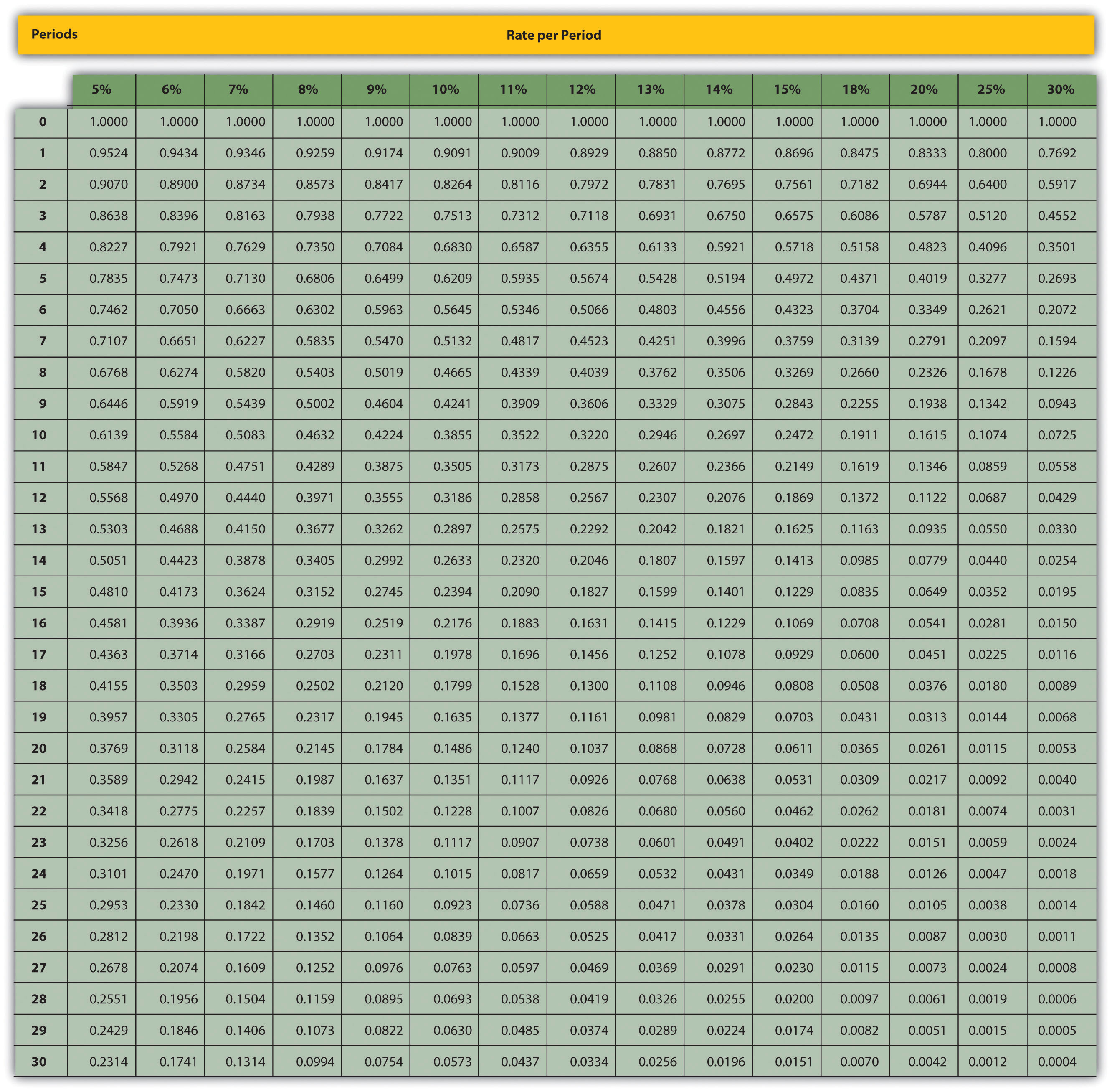

NPV is not an easy manual calculation, so it is best to use a calculator, an online tool, or Excel (NPV function).

I Need To Calculate The Net Present Value Of The New

Ideally, as mentioned, your organization has set a discount rate, but if not, a simple change would be how much interest you could get on the investment dollar if it were deposited into a bank account instead of funding the project.

The best use of NPV in project management is in the business sector, where it can provide stakeholders with a clear yardstick to determine whether or not an investment has been made. For organizations that have many projects in their portfolio and must carefully choose which projects should be prioritized to allocate the investment budget shortfall, NPV provides a way to do this.

In project management, NPV stands for net present value, a metric that helps determine return on investment.

Net Present Value (NPV) or Net Present Value (NPW) is a capital budgeting method used as part of a Cost Benefit Analysis (CBA) to determine the profitability of an investment. Net present value allows project stakeholders to determine whether future benefits are greater or less than the initial investment.

Post Discounting For Long Term Assets And Liabilities In Sap S/4hana Cloud

A negative net present value would mean that the project cannot generate a positive return. A negative NPV does not always mean that the business case should be rejected (for example, a compliance project may have a negative NPV), but a positive NPV will appear more attractive when deciding how to allocate scarce investment dollars.

Monday Coffee with. Atlassian News Monday Coffee With – What’s New with Atlassian | April 26, 2021 Every Monday morning, we explore news and updates from the Atlassia ecosystem. Join Nicky and Biro for a cup of joe and a quick chat about Atlassian’s acquisition of ThinkTilt, new features in Confluence, great insights from Atlassian on how to do research, and more.

Monday Coffee with. Atlassian News Monday Coffee With – What’s New with Atlassian | April 19, 2021 Every Monday morning, we check out news and updates from the Atlassia ecosystem. Join Nikki and Biro for a cup of joe and a quick chat this time about Confluence’s new timeline feature, app promo codes, the Tempo hackathon, and more. Question. We now have tools to calculate the present value of future cash flows. flows. , we can use this information to make decisions about long-term investment opportunities.

Answer: Net Present Value (NPV) is a long-term investment valuation method. It is calculated by adding the present value of all cash inflows and subtracting the present value of all cash outflows. The investment valuation method adds the present value of all cash inflows and subtracts the present value of all cash outflows. Name:

How To Calculate Net Present Value (npv) In Cre

Also used to describe the NPV method. In the previous section, we explained how to find the present value of cash flows. Name:

Means the aggregation of the present value of all cash flows associated with an investment (both positive and negative).

Remember the problem with Jackson’s quality copies at the beginning of the chapter. Company President and Owner Julie Jackson would like to purchase a new copier. Julie believes that the investment is important because the copier’s lifetime income is $82,000 and cash outflow is $57,000, resulting in a net cash inflow of $25,000 (= $82,000 – $57,000). However, this method ignores time

Net present value calculator, calculation of present value, net present value npv, example of net present value calculation, net present value calculation, net asset value calculation, formula for net present value calculation, net present value calculation excel, net present value calculation in excel, net present value example, net present value calculation example, calculation of net present value

Post a Comment for "Calculation Net Present Value"