Net Asset Value Meaning Of – In mutual funds, the investment return is much more important than other elements such as tax savings or dividend income. Therefore, it is important to understand how the return on fund investments is calculated? What aspects or principles are taken into account? This is where we come to a concept called “Net Asset Value”. Investing in mutual funds involves the purchase of shares in a mutual fund scheme. Each unit initially starts at its base price and goes up or down based on performance. This performance of a mutual fund scheme can be measured by calculating the net asset value of each unit in the scheme.

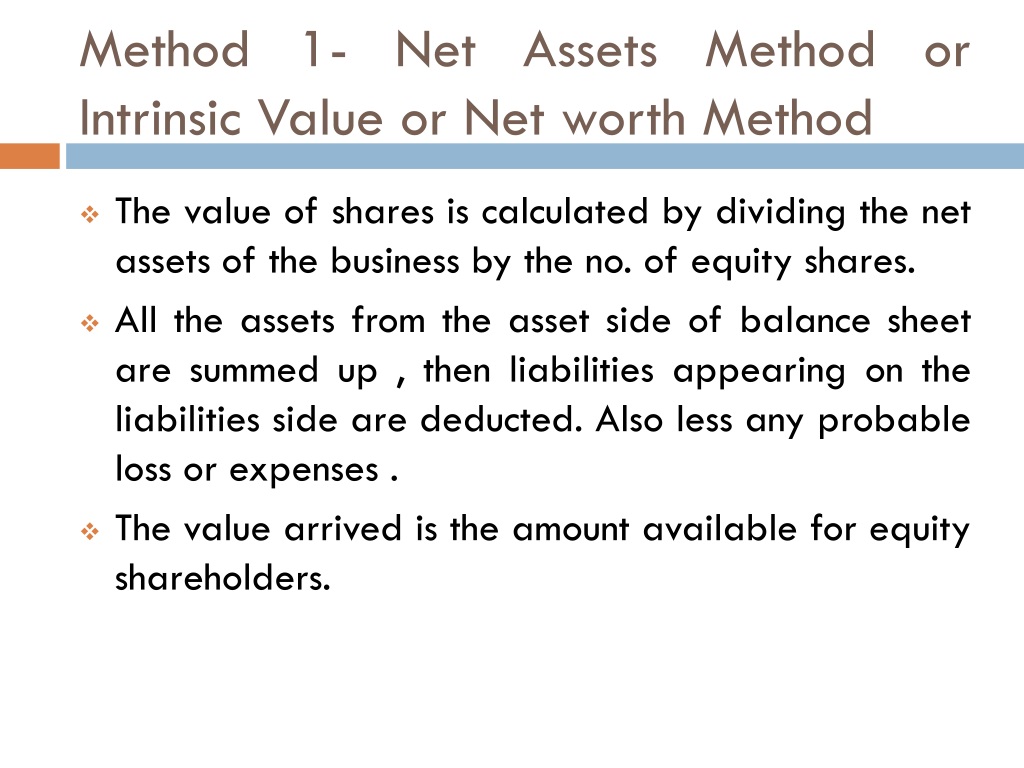

NAV stands for Net Asset Value of a share fund plan. It is the value derived by subtracting the liabilities from the total asset value of the mutual fund scheme per share. It is the price at which you buy one share of a mutual fund scheme. That’s the price you can also sell the unit at (unless another charge applies).

Net Asset Value Meaning Of

Now by dividing the amount A by the total number of units outstanding (which can vary in an open scheme with regard to the possibility of easy entry and exit) we calculate the price per unit at the end of the day. This unit price allows you to purchase a scheme unit if there is an exit load. This is nothing more than the net asset value per share of the securities fund scheme.

Enterprise Value: Formula And Calculator (step By Step)

The share prices are directly proportional to the NAV decision factor provided that the fund scheme is not related to money market instruments or otherwise. The exchange ends at 3:30 p.m. afternoon and when the market is closed, the market value for that day is frozen. The expenses for the given day are then deducted and the money available for distribution to the shareholders can be calculated. Once all the variables are available, the fund managers use the above formula to calculate the net asset value of the scheme. Investments in mutual funds are always time-bound. All investment amounts received by 2 p.m. they are seen in closing and investments after 14:00. they are credited the next working day. The same rule applies to redemption. It is not possible to calculate the NAV without being able to calculate the exact outstanding units that are available at the end of the day.

It’s easy. It increases if most of the securities in which the system has invested go up and vice versa. However, it is a common misconception that NAV is the price of a share of shares, which is very wrong. The price of a company’s shares is reflected in the stock market and is the result of many factors such as past performance, future prospects, demand-supply of such securities, etc. Therefore, the price of a share is different from its book value. Whereas when it comes to mutual funds, the prices you see are all NAV and nothing else.

We have seen the theoretical method for calculating NAV. Let’s add some meat to the skeleton of the formula by adding some numbers. Suppose that at the end of the day i.e. at the end of the trading day, the fund manager has Rs. 10, 50, 00, 000 (ten million and fifty lakhs only) securities, Rs. 10,00,000 (Rupees ten lakh only) in cash and Rs. 5,00,000 (Rupees Five Lakh only) accrued as debt. Then the NAV for the scheme with 20,000,000 outstanding units at the end of the trading day will be:

Here Rs. 10, 50, 00, 000 (ten million and fifty lakhs only) is the market value of the investment made from the scheme, while Rs. 10,00,000 (Rupees Ten Lakh only) is the liquid amount lying in the bank as unused money aggregated to the total assets of the scheme. 5,00,000 (Rupees Five Lakh only) is nothing but the expenses incurred for the management of the funds, which may include expenses such as fund manager’s fees, bank charges and other overheads. Now the net asset value is calculated assuming that if all the shares in the mutual fund scheme are liquidated at the end of the trading day, how much money can be obtained per share.

Net Asset Value (nav): Definition, Formula & Uses

After liquidation, the fund manager cannot share all the money, because he must first pay all incurred expenses, including his own fees, which together lead to the fund’s liabilities. The remaining balance is now available for sharing between all shareholders. Shareholders do not own unit shares, so it is convenient to calculate the price per share ie 20,00,000 units outstanding at the end of the trading day.

So if a person owns 10 units, his total investment will cost = 52.75 x 10 = Rs. 527 (approximately). This is from the seller’s point of view.

Let’s take a look at the buyer’s perspective. If a buyer wants to invest 1000 rupees (one thousand only) in the above scheme, he can buy around 18 units (1000/52.7).

As prescribed by SEBI Mutual Fund Regulations, it is mandatory to calculate NAV on daily basis and publish it. NAV is not the only factor that can determine the performance of the system, but it is the primary factor for assessment. It helps investors understand the value of their investment and helps potential buyers compare schemes.

Quiz & Worksheet

Let’s take the example of owning a house bought on credit. The house will be mortgaged to the bank. Now the home owner’s net worth will be the market value of the home minus the total outstanding loan.

In mutual fund schemes, the higher the net worth, the higher the NAV. The fund manager’s task is always to maximize total assets and minimize liabilities. Net assets does not necessarily mean real profit as it also includes theoretical profit. Assume an investment of Rs. 100 is valued at 10% which is equivalent to Rs. 10, this Rs. 10 cannot be realized until the investment has been sold. However, this increase in value is added to the calculation of total assets. Likewise, the expense, even if it is to be paid later, becomes part of the total obligation. This principle is called the accrual principle, which is inherent in accounting. Therefore, future profits or future expenses in net assets are very important.

However, this does not allow for the inclusion of contingent profit or contingent expense in the calculation of net assets. A contingent profit or expense is nothing more than a profit or expense calculated on the basis that a certain event will or will not occur, or simply put, a speculative profit or loss. Due to its vagueness it is not possible to include the same.

The valuation of unit certificates in mutual funds largely depends on the valuation of the securities the scheme invests in. Securities, if listed, are valued based on their value at the end of the trading day. For example, if the shares of A are valued at Rs. 700 at the end of the trading day and the total number of outstanding shares of A is 10,000, then the market value of security A is 700 x 10,000 = 70,00,000 and hence all these securities in the group are valued.

Things You Need To Know About Mutual Fund Nav

If the security is not listed, the earnings per share (“EPS”) method is used. EPS is nothing but the total funds available to shareholders divided by the number of shares outstanding. It gives you the current price of one share and if you multiply the same by the total number of securities, you get the value of your investment. Peer Group is another alternative to the EPS method, where the valuation is based on the valuation of companies with a similar subject or industry.

Mutual funds with investments in debt securities can be valued according to their return. Debt securities are securities with a higher risk aversion, the valuation of which does not depend on the market, but on the credit rating of the debt securities, their maturity, past dividends and repayment history to the issuer. In the study of valuation, one may also come across the term “Non-Performing Asset”, which is nothing but an asset that has gone bad due to non-fulfillment of its payment obligations. In such cases, to make the books look good, NPAs are written off, which means written off from profits. But if these NPAs become profitable in future, they can be put back and treated as a current asset.

Mark to Market is a valuation method where each security in a group is valued according to its market value. Mutual fund units are valued based on the daily NAV, which in turn depends on the security’s value. It is important to use this method to value securities, otherwise the entire investment will be valued at the cost of purchase, resulting in a loss

Net asset value of fund, net asset value reit, net asset value of a company, definition of net asset value, net asset value private equity, net asset value of gbtc, net asset value of shares, calculation of net asset value, meaning of net asset value, net asset value, formula of net asset value, net asset value of company

Post a Comment for "Net Asset Value Meaning Of"